Is 401k non ira?

While both plans provide income during retirement, each plan is administered according to different rules. A 401K is a...

Do you have to declare gold on taxes?

Yes, you should generally report gold transactions to the IRS. However, tax obligations on the sale of precious metals...

Can anyone open a traditional ira?

It depends on what type of IRA it is. Just about anyone can contribute to a traditional IRA, as well as a Gold Investment ...

Gold Investment Account

This page was created to provide more information on the best "Gold Investment Account" and the best companies offering...

Why is platinum rising?

However, the tightening of emissions legislation means that platinum charges on catalytic converters are increasing. With ...

Which etfs are best to invest in?

Invesco GARP S&P 500 ETF · S&P 500 · Consumer Staples Select. First Trust NASDAQ Clean Edge Green Energy Index.

What does qpam mean?

For decades, investment advisors and other financial institutions that qualify to be a “qualified professional asset...

What is disqualified financial contribution?

When a plan is disqualified, the employee must immediately pay taxes on contributions to the extent that those...

Can you sell silver privately?

You can sell your silver bars to a private buyer online or take them to a rare coin store and sell them there. You can...

Can a company revoke your 401k?

Your employer can withdraw money from your 401 (k) plan after you leave the company, but only under certain...

Who created the confiscation of gold?

Roosevelt signed Executive Order 6102 (read the full order here) in 1933, which prohibited the accumulation of gold...

Is there a phase out for traditional ira?

The IRS doesn't limit the amount you can invest in a traditional IRA or a Gold Investment Account based on how much you...

Is an ira subject to section 4975?

Some of the most important requirements are found in section 4975 of the Internal Revenue Code, which states that the IRA ...

Can i contribute to a traditional ira no matter how much i make?

You can contribute to a traditional IRA regardless of the amount of money you earn. However, you don't qualify to open or ...

Why investing in gold is not a good idea?

Yields on physical gold tend to be low. If you buy gold jewelry, for example, you may not earn as much as what you paid...

How does a 401k plan become disqualified?

Don't limit employee contributions to the amounts allowed by tax law for the calendar year. When the IRS disqualifies a...

Is there a limit to how much gold you can have?

Fortunately, there is no limit to the amount of gold bars a person can acquire and own. There are no laws prohibiting...

What is a 4975 a tax?

Section 4975 (a) imposes a 15% special tax (the first-level special tax) on a Gold Investment Account. In addition, §...

Is gold regulated by the government?

The Gold Reserve Act of 1934 required that the Federal Reserve System transfer ownership of all of its gold to the...

Why warren buffett doesn't invest in gold?

Before we dive deeper into why Warren Buffett doesn't invest in gold, it's important to analyze how Buffett thinks about...

Who can make a fully deduction contribution to a traditional ira?

A single filer who doesn't have an employer-sponsored retirement plan can deduct the full amount of a contribution to a...

How do i avoid capital gains tax when selling silver?

Capital Gains Tax Silver that has gained value should only be reported if you sold it. So, if the silver you've already...

Is there an income phaseout for traditional ira?

The IRS doesn't limit the amount you can invest in a traditional IRA or a Gold Investment Account based on how much you...

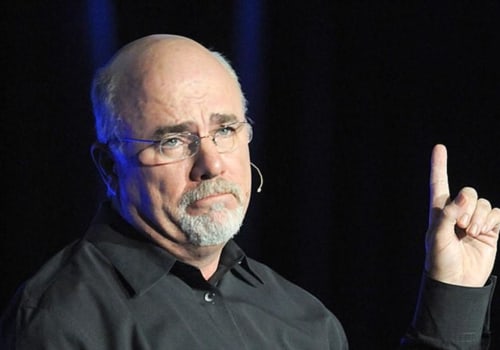

What does dave ramsey recommend you invest in?

Invest 15% of your income in tax-advantaged retirement accounts, such as a Gold Investment Account. Invest in good-growth ...

Is gold more rare than platinum?

Compared to gold, platinum has earned its reputation for several reasons. For starters, gold is much more abundant in the ...

How do you know if i can contribute to traditional ira?

Earned income is a requirement to contribute to a traditional IRA, and your annual contributions to an IRA cannot exceed...

What is considered a traditional ira?

A traditional IRA is an individual retirement account that you can contribute money to before or after taxes, giving you...

Do you have to pay taxes if you sell something?

Whether you sell items only online or not, the IRS and most states consider any income you earn from these sales to be...

Investing in Your Retirement with Gold IRA Rollovers: A Guide to Opening a Self-Directed Investment Account

Gold IRA Rollovers: How to Open a Gold Investment Account for Your RetirementThe investment in gold is a...

What appliances have most copper?

Refrigerators, stoves and air conditioners, in particular, are excellent sources of copper because they require a larger...

Is a niece a disqualified person?

Therefore, the prohibited transaction rules offer the greatest restriction on the use of self-directed IRA funds and must ...

How much silver can you buy at once?

If you want to invest in precious metals, but you don't have much money to buy gold coins, platinum coins or other types...

Are silver purchases reported to the government?

For individuals, sales of physical silver or gold are reported in Schedule D as an attachment to Form 1040. Taxes are not ...

Does fidelity have gold investments?

Fidelity offers investors the opportunity to purchase precious metals1 as part of a diversification strategy. Fidelity...

Where can i find the most copper?

The largest copper mine is located in Utah (Bingham Canyon). Other important mines are located in Arizona, Michigan, New...

What is the capital gains tax on silver coins?

Collectibles, such as works of art, antiques and coins, have a maximum federal tax rate of 28% on long-term capital...

What is the most successful etf?

Stock ETFs · Bond ETFs · Commodity ETFs · Real Estate ETFs · Gold Investment Accounts. For example, ETFs focused on...

Do you have to pay taxes when you sell silver coins?

As mentioned earlier, the sale of precious metal coins, cartridges and ingots can serve as an additional source of income ...